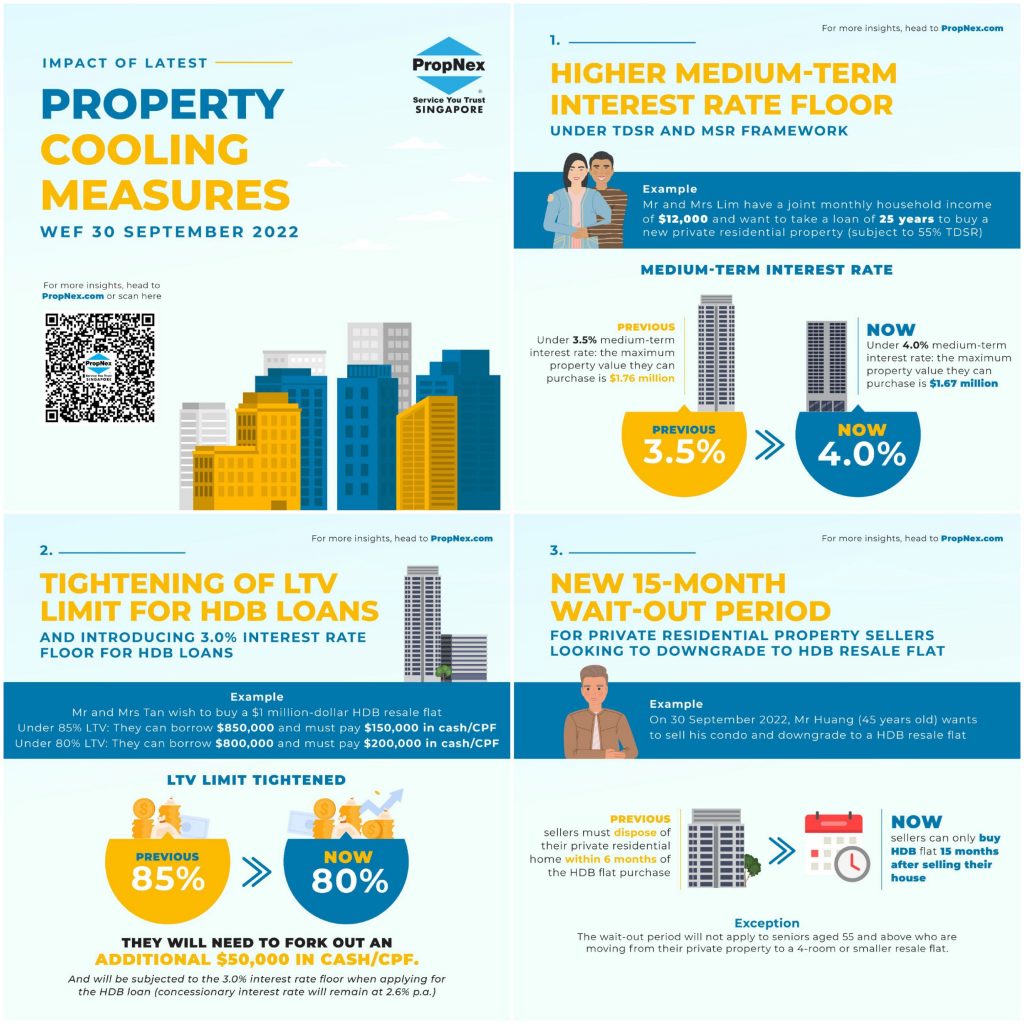

The new cooling measures were effective from 30th September 2022 and it hit us like a passing hurricane, with almost no time to react! How does the new rules affect the property market going forward?

To summarize the illustration above in points.

1. Loan-to-Value or LTV will be tightened further from 85% to 80% for any HDB Purchase.

2. Property owners who decide to sell or have sold their private properties are now impeded from purchasing resale HDB Flats with a 15 months cooling period. This means ex-private property owners are forced to wait before they can their option-to-purchase for a resale HDB can be registered with Housing Development Board (HDB).

3. Floor interest rates are equivalent to stress test rates, which are to be raised from 3.5% to 4% for all Financial Institutions or Bank Loans. Additionally, housing loans from HDB or the HDB Loan Eligibility (HLE) shall raise their floor rates from 2.6% to 3.0% in tandem with the floor interest rates increase for bank loans. Therefore, we are looking at a 4% or 3% rule of interest rate calculations for a Bank Loan or HLE Loan respectively.

Notice that majority of the tightening are targeted towards the HDB market, with the objective in mind for further housing affordability in Singapore. Especially during the first Forward Singapore Engagement Session on 25th September 2022, the younger generations have expressed reasonable concerns on HDB flat affordability. Such high prices have then lead the younger generations to put a halt on their home purchase plans, with some being unable to afford or personally felt that the property prices are too high. Additionally, the prices and entry affordability for HDB flats have been surprisingly buoyant to the global economy, with more transactions of more than one million dollar HDB flat transactions appearing. (Click here to read my other article on million-dollar HDB flats)

Advice to home buyers & Conclusion

Review your finances and timeline properly. If interim accommodation is not an option for you, a new executive condominium may be the right option to consider. Ultimately, it boils down to what is your objective to the move or home upgrade. Whether it is an investment or preferential home objective. No right no wrong.