This is not about million-dollar flats but the question to ask ourselves, “How much will resale Housing Development Board (‘HDB’) flats be selling for the next 5 to 10 years?”

According to official data from data.gov.SG (as of 8th September 2022). We know that the volume of Million-dollar HDB flats are appearing more frequently than before and are expecting to see over 300 such flats sold by the end of 2022.

Among the million-dollar HDB transactions alone this year, nine were in non-mature estates compared to only one such transaction in 2018. Even I was shocked to see the rapid rising volume of the non-mature estate sales, which exceeded the transaction price of above a million-dollars.

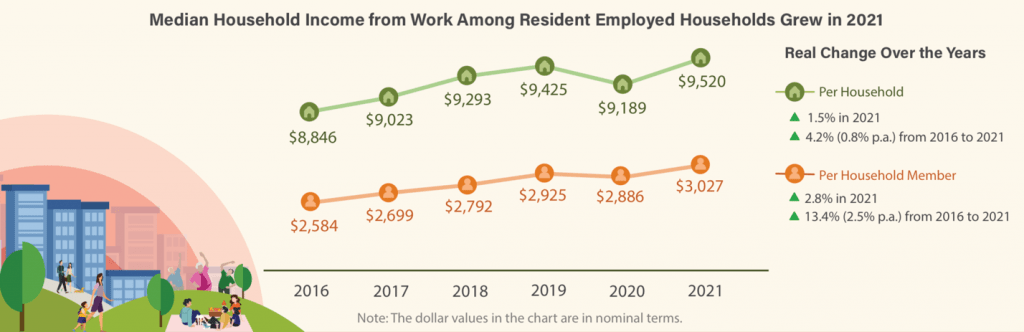

Then how do we determine the future selling prices of a newly 5 or 10 year minimum occupation period (MOP) HDB flat? An article released by “The Straits Times” shows that 2,541 applicants were vying for both the 372 five-room and three-generation built-to-order (‘BTO’) flats at Central Weave @ Ang Mo Kio, despite a selling price within the range of $713,000 to $877,000. It is apparent to us that demand for housing remains above the market supply with financially capable buyers. This phenomenon is supported by the growing income among Singaporean households. (See picture below by Singstats)

With that said, everyone who has bought a HDB BTO flat is more than likely to sell at least a $100,000 in profit margin or in a real estate agent’s perspective, a Singaporean’s first pot of gold. This trend has been enforced with the first hand owner’s subsidized buy in price with HDB through the BTO system. So ask yourself this, if you were a lucky first hand owner who had managed to purchase the Ang Mo Kio five-room flat for $800,000. How much will you sell in 10 years time, right after the 10 years prime location housing MOP?

P.S I myself am selecting my three-room BTO in Toa Payoh at this present time of writing and will write my own experience in another article altogether.

My own experience before selection

My three-room BTO in Toa Payoh (‘Kim Keat Heights’) will cost me up to $380,000 +/- estimate, with a 5 year construction timeline to collect keys latest by 2027, thereafter with the 5 year MOP commencement. This timeline will take minimally 10 years of my life, and it may not be ideal for young couples or families who are looking for an immediate move-in.

Furthermore, with the limited supply of new HDB Flats in Singapore, what will my selling price be after my 5 years MOP? I surely will not be selling at my cost price right now that I am entering, and I won’t be selling below cost as well. My neighbours and I generally are entering at the same per square foot (‘psf’) in the present market now for a new HDB BTO flat in a mature estate, that means we will all be on an equal footing during our time of sale. Finally, perhaps I may let go at $600,000 or more, based on the present market transactions for newer HDB flats that have just reached MOP and selling at two-folds the price that they had initially bought for.

Advice to home buyers

In spite of the above, do remember that our property market follows not only the internal market and interventions, but also the global economy or events. Do take note that Singapore property market does follow relatively to the median income of resident households. Cooling measures are taken into account to accommodate the trend, in order to prevent a housing bubble appearing.

I understand that the property market may have been cruel to you at this point of time. Where in doubt, especially for first timer couples or families, feel free to whatsapp me using the floating button on the right of your screen. I am open to help you out and provide a complimentary advisory for your early planning in getting a home.

Your next move

Do not take this the wrong way, I do not mean that new condos or developments in Singapore are the only potential way to make safeguard your property asset. Even buying into a new condo, requires prudence and due diligence on our part and yours.

Additionally, there is still manageable growth in the resale market subjective to the respective projects and we can find out more after setting your goals to buy real estate in Singapore. I love to share more on my opinions and help you convert your objectives into a holistic real estate portfolio.

Conclusion

I strongly suggest young couples to try balloting for a BTO as their first home together. Alternatively, you may find the need for an immediate move-in or are just so tired of the failed attempts in your BTO balloting, which resulted in the shift of your focus to a resale HDB or Condo.

Do not hesitate to contact me using the WhatsApp Floating Button on the right of your screen. It will be my pleasure to provide you with direction and focus using my own crafted Personalized & Systematic 5-step Advisory Process, the ‘Risk Management, and Empowerment Approach’.