More unsold private homes are stacking up as we gear up for a wave of new launches in 2024

Rising number of unsold new private homes

In Singapore, the number of unsold new private homes has gone up by 20% in the past two years and is expected to keep rising in 2024 with more projects hitting the market.

This could spell trouble for new launch projects nearing their sales deadline, facing the pressure to sell all units or pay heft additional stamp duty fees.

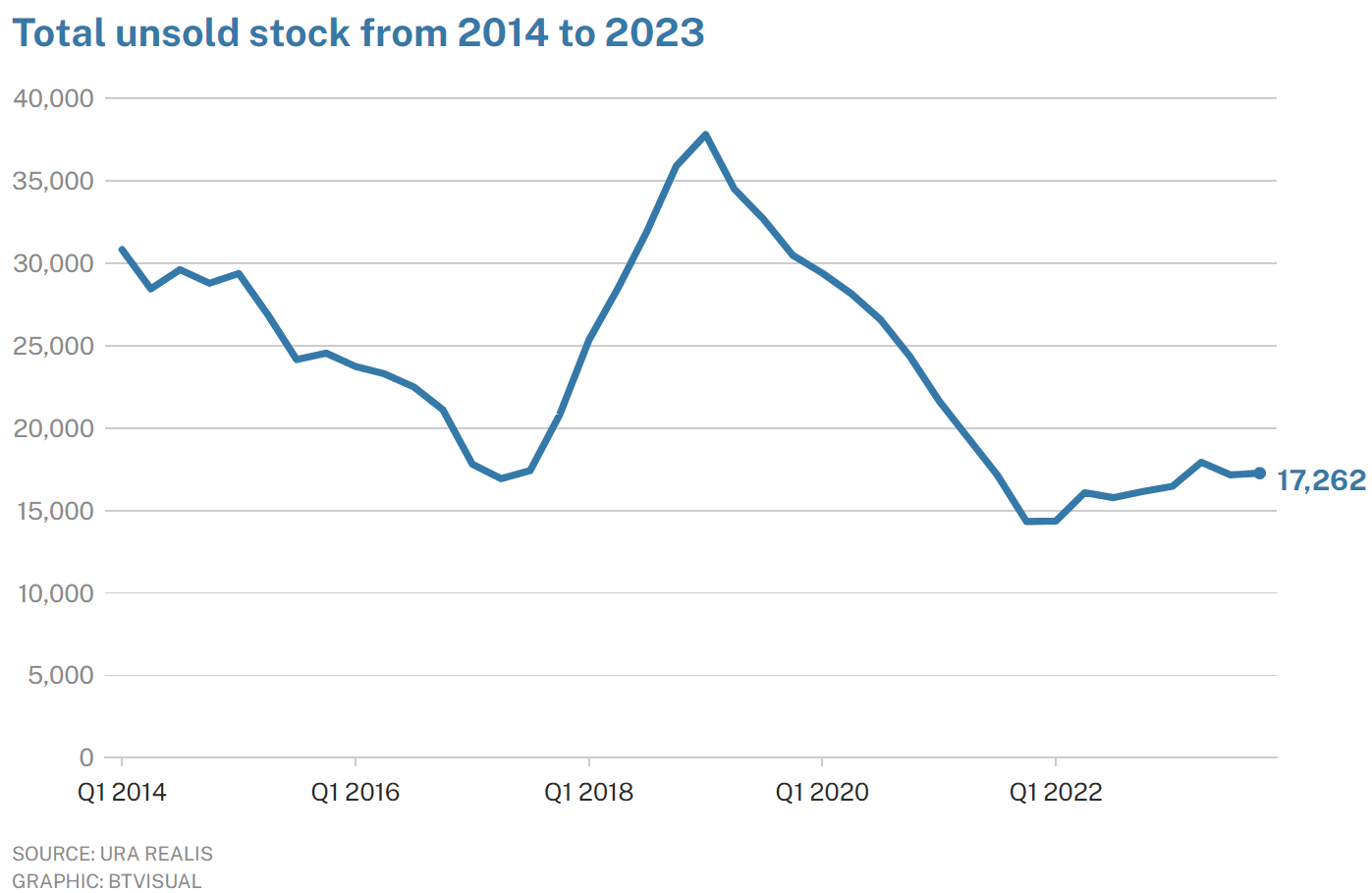

Recent data from the Urban Redevelopment Authority (URA) shows a 20.4% increase in unsold homes from 14,333 units in Q4 2021 to 17,262 units in Q4 2023.

This rise of unsold new private homes is likely the outcome from the many new launches happening in 2024 alongside cautious demand in the market, influenced by cooling measures and high financing costs.

How did it happen?

Back before in 2023, new home sales dropped by 9.6% compared to the previous year, while the number of new condominium launches surged by 66.8%.

The government had also increased the supply of private homes, with 9,235 units scheduled for sale from the 2023 Government Land Sales (GLS) programme, and these land sales are slated for sale on schedule regardless of demand.

The aftermath was a natural uptick in unsold new private homes.

Simultaneously, numerous new launches may be approaching their crucial sales deadline this year in 2024, still burdened with a significant number of unsold units.

Projects approaching ABSD deadline

Based on data from URA’s Realis database as of March 12 2024, these projects encompasses the 99-year leasehold Cuscaden Reserve in District 10, with 180 units unsold out of 192; the 99-year leasehold The Landmark in District 3, with 51 remaining units out of 396; and the 99-year leasehold One Bernam in District 2, with 137 units still available out of 351.

Further insight reveals that other projects like the freehold Leedon Green and freehold Dalvey Haus, both in District 10, might also be facing a critical five-year deadline this year, with fewer than five unsold units left.

Developers five-years timeline

In residential projects featuring five or more units, property developers face an Additional Buyer’s Stamp Duty (ABSD) of 40 percent on the land price, with 35 percent of it being remissible if the developer manages to sell at least 90 percent of the units within five years. Otherwise, this portion of the ABSD is due with interest.

For land sites acquired between July 2018 and December 2021, the payable ABSD stands at 25 percent, with a non-remissible component of 5 percent and Land acquired before July 2018 is subject to a 15 percent rate.

The ABSD remission claw-back rate is contingent upon the number of unsold units, a provision unveiled during Budget 2024. This adjustment aims to grant housing developers more flexibility in unit sales while ensuring a prompt release of housing supply as articulated by Finance Minister Lawrence Wong.

Things might be better in a different market environment

Reflection & Opinions

It might be a good sign that more new homes are unsold since the low point in late 2021. It means there’s more houses available now that the pandemic’s effects are easing up.

In the last quarter of 2023, there were about 17,262 new homes still unsold. That sounds like a lot but compared to the average number of unsold homes over the past few years, it’s actually not too bad. Back from 2014 to 2023, the average was about 23,885 unsold homes.

And get this; the number of unsold homes now is less than half of what it was in early 2019. It’s also only about 60 percent of what it was in late 2014.

Back in 2017, when the housing market was at its lowest, developers started buying up land quickly. This led to a bunch of new housing projects in 2018 and 2019, which peaked in early 2019 with lots of unsold homes.

After that, there was hardly any unsold homes for a long time. This made the housing market super tight, causing prices to shoot up because there were so many people looking to buy.

Between mid-2017 and early 2019, home prices went up by just 8.6 percent. But since then, they’ve gone up by a huge 33.7 percent. That’s a big difference in just a few years!

When you look at the average number of homes developers sold each year from 2014 to 2023, which was about 8,850, the 17,262 unsold homes now is only enough for about two years’ worth of stock.

Experts think there might be more unsold new launches coming up, but it’s not expected to be as bad as before.

What happens in late 2024 will depend a lot on how many new homes get sold and how many new projects get started. An estimated that there might be between 18,000 and 19,000 unsold homes by the end of 2024. But even that’s way less than the almost 38,000 unsold new homes we experienced in early 2019.

Still, I do not think we will see more than 22,000 unsold homes since people are still buying houses and there’s no sign of a financial crisis coming up in 2024 as of now. If you are out there looking to buy a new or resale private property, be mindful of your affordability and future asset preservation, which I wrote in my previous article on ‘What are URA’s Reserve & Confirmed Sites? How do they support your Future Home Value?‘.