The recent launch of ‘The Reserve Residences’ which gathered 71% of new home sales on their preview has sparked many readers and potential property buyers befuddled at such a positive response.

If you have not heard of it, ‘The Reserve Residences’ is a 99-year leasehold integrated-development, with a shopping mall, like the Sengkang Grand Mall or Woodleigh Mall which recently achieved their Temporary Occupational Permit ‘TOP’. It is in district 21, along Jalan Anak Bukit that is conveniently close to the iconic Beauty World MRT. (See link attached below)

https://www.channelnewsasia.com/commentary/snap-insight-absd-property-cooling-measures-affordability-3448136

While it’s apparent a clear positive demand is still within the property market, there are still many home buyers and investors who are already holding back due to the current exorbitant interest rate or additional buyer stamp duty tax.

Nevertheless, there are several push factors that could be the reason behind the resilient decision for buyers to buy their property now instead of waiting for an inverse effect to the property market. As there are many considerations, I will highlight two such factors for your studies.

1. Public Housing Knock-on effect

As an owner of a recent BTO at Toa Payoh Kim Keat Ridge back in 2022, I speak from my perspective that the waiting time for completion has truly lengthen compared to pre-covid times, and we are looking at a lead time of about 5 to 7 years before collecting keys. We are looking at a timeline estimated around 10 years of life time before we are able to liquidate the asset or choose to move location due to personal circumstances.

If your BTO falls under the Prime Location Housing (‘PLH’) scheme, expect at least 15 years of wait before you are legally entitled to sell your HDB Flat. This long duration has spurred many potential home buyers to consider the private home market, and as the soaring prices continue to rise despite the economic uncertainties, the confidence in Singapore’s real estate market proves to be resilient. Thus, the fear of losing out to the rising prices may have contributed to the private new home transactions as undecided potential buyers worry that they would not be able to afford to buy a private property in the future.

2. The Fear Of Being Further Priced Out

If you had noticed, the past few cooling measures that were implemented were mainly targeted towards investors or trustee, and foreigner property buyers. It was not fully intended to curb the Singapore Citizens or Permanent Residents first-time homebuyers, with the additional buyer stamp duty remaining at 0% and 5% respectively. Despite the ABSD increase in 2nd or 3rd home ownership onwards, we are still encountering the potential local or foreign investors snapping up new home sales.

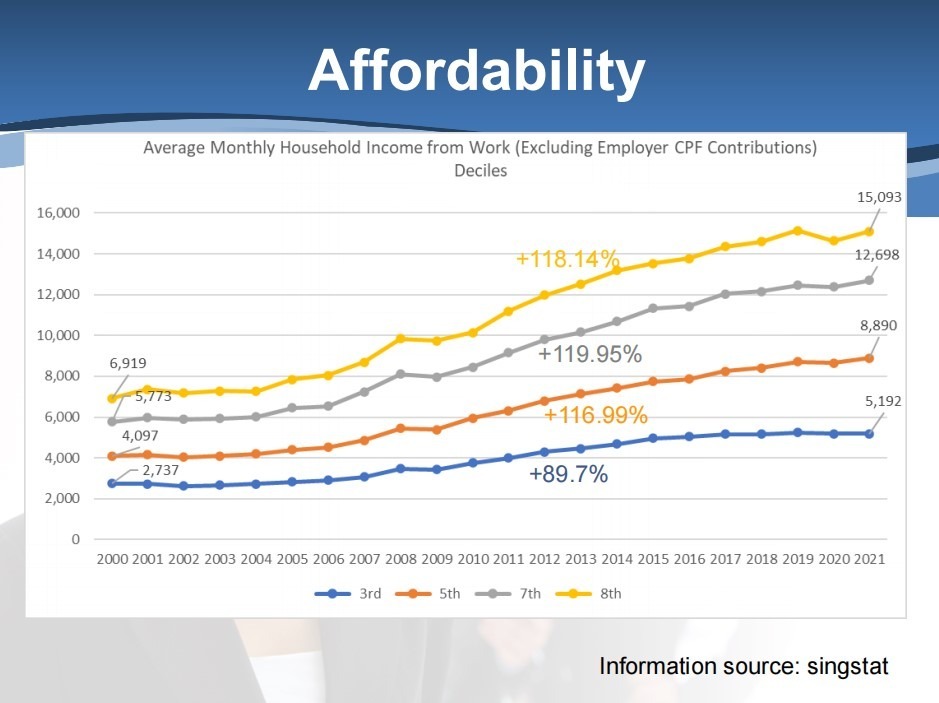

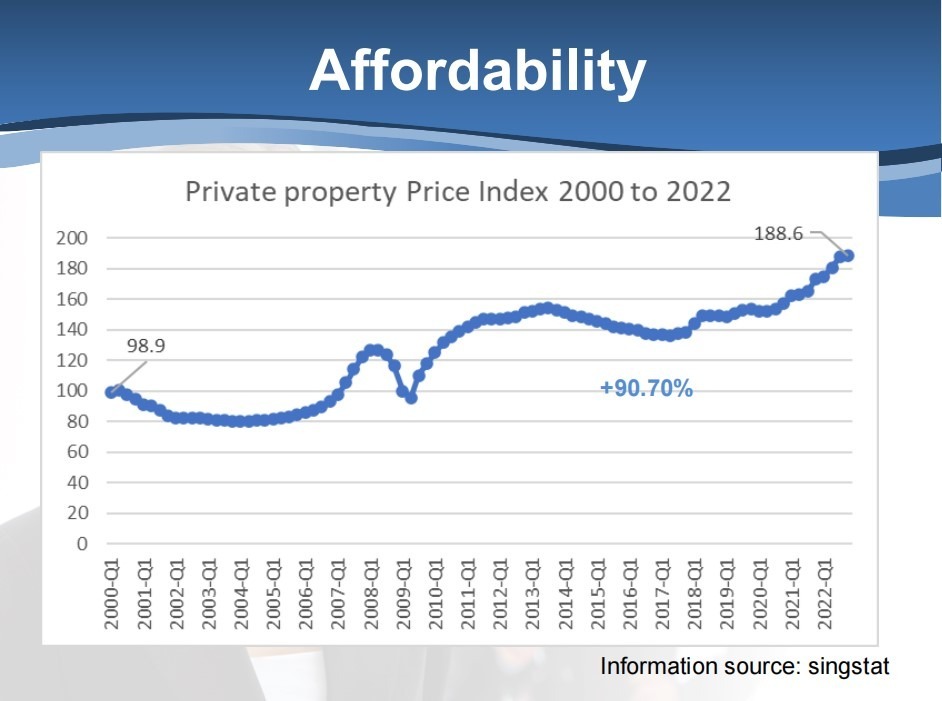

Pictures say a thousand words. The extracts from my quarterly market insights research shows the increment of median household salary in relation to the private property price index of a timespan from 2020 to 2022.

Q. Will the confidence of the potential buyers in the market so firm that our market acceptance to price ratio has come to an equilibrium to cause a new generation of prices?

(Hint to observe. Study the private property price index trend to macro & micro events)

Advice to home buyers & Conclusion

Q1 statistics and the recent successful launch of the new private homes shows a clear knee-jerk and inverse psychological effect towards the undecided potential home buyers, investors or foreigners alike.

Regardless of a normalization of the private property market, the past trends shows a clear resilience after every crash to the reserve line but take note that we are in a different environment post-covid pandemic, with inflated supply chain prices for construction build, manpower, and logistics. It is a clear indication that once cost prices have increase, with market and society acceptance, it may not likely fall.

It also differs from every household affordability. This article does not constitute in any form of advisory or direction. Please consult your real estate advisor. You may drop me a call or WhatsApp me. I believe that the sharing of my quarterly market insights and F.A.S.T Advisory method will be able to show you a clearer direction in your property journey.